The 6-Minute Rule for Pvm Accounting

The 6-Minute Rule for Pvm Accounting

Blog Article

The Best Guide To Pvm Accounting

Table of ContentsAbout Pvm AccountingThe Definitive Guide for Pvm AccountingTop Guidelines Of Pvm AccountingSome Known Factual Statements About Pvm Accounting Rumored Buzz on Pvm AccountingThe Definitive Guide for Pvm Accounting

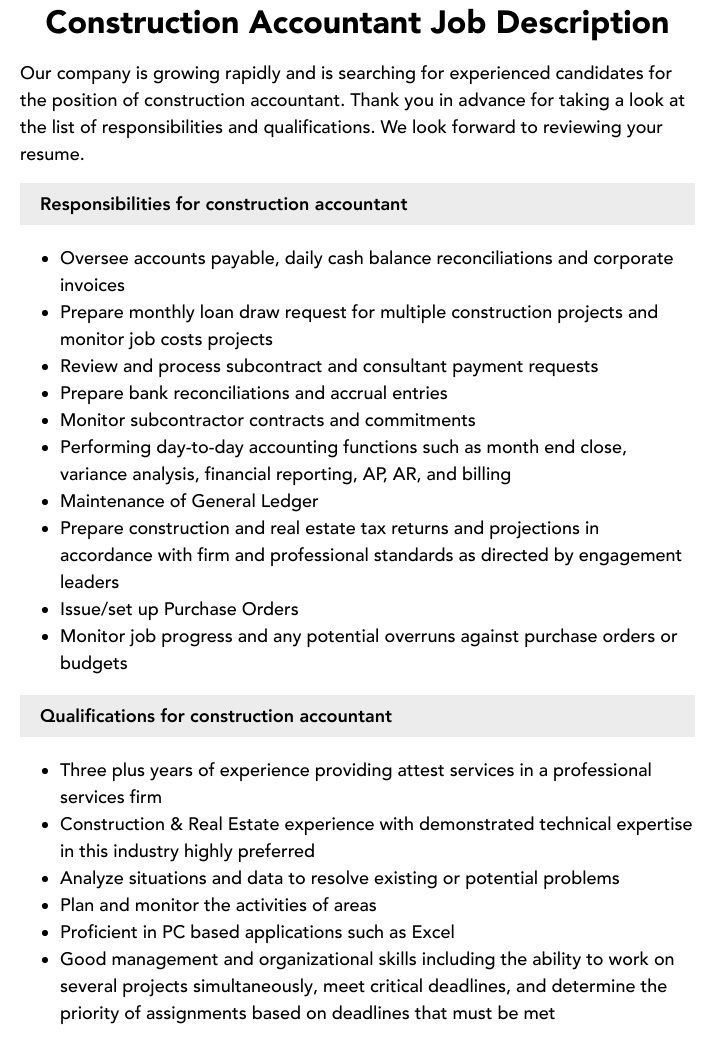

Ensure that the accountancy process conforms with the regulation. Apply required building and construction accounting requirements and treatments to the recording and reporting of building and construction task.Understand and preserve typical cost codes in the accountancy system. Connect with different funding firms (i.e. Title Company, Escrow Firm) pertaining to the pay application process and requirements needed for repayment. Take care of lien waiver dispensation and collection - https://www.quora.com/profile/Leonel-Centeno-4. Display and fix bank concerns including fee anomalies and check distinctions. Help with implementing and keeping interior financial controls and treatments.

The above statements are planned to define the general nature and degree of job being executed by individuals appointed to this category. They are not to be taken as an extensive list of duties, tasks, and skills called for. Personnel might be needed to carry out duties beyond their typical duties every so often, as required.

The Best Strategy To Use For Pvm Accounting

You will certainly help support the Accel group to make sure distribution of effective on schedule, on budget plan, jobs. Accel is looking for a Building and construction Accountant for the Chicago Office. The Construction Accountant performs a variety of bookkeeping, insurance conformity, and task management. Works both separately and within certain divisions to keep economic records and ensure that all documents are kept present.

Principal obligations consist of, however are not restricted to, handling all accounting features of the business in a timely and precise way and supplying records and routines to the firm's CPA Firm in the prep work of all economic declarations. Makes certain that all accountancy treatments and features are taken care of accurately. In charge of all financial documents, pay-roll, financial and daily procedure of the audit feature.

Works with Task Supervisors to prepare and upload all regular monthly billings. Creates month-to-month Task Price to Date reports and working with PMs to resolve with Project Managers' spending plans for each task.

Indicators on Pvm Accounting You Should Know

Effectiveness in Sage 300 Building and Property (previously Sage Timberline Workplace) and Procore construction management software program an and also. https://disqus.com/by/leonelcenteno/about/. Must likewise be skilled in various other computer software program systems for the prep work of records, spreadsheets and other audit analysis that might be needed by monitoring. financial reports. Need to have strong organizational skills and capacity to prioritize

They are the financial custodians who guarantee that building and construction tasks stay on budget, abide by tax guidelines, and preserve financial transparency. Building and construction accountants are not simply number crunchers; they are tactical companions in the building and construction process. Their main function is to handle the monetary aspects of building and construction tasks, making certain that resources are alloted efficiently and monetary risks are decreased.

Some Known Factual Statements About Pvm Accounting

By keeping a tight hold on project financial resources, accountants assist protect against overspending and monetary problems. Budgeting is a cornerstone of effective building tasks, and building accountants are important in this regard.

Browsing the complex web of tax obligation policies in you can try these out the building and construction industry can be challenging. Construction accounting professionals are fluent in these laws and make sure that the project follows all tax obligation demands. This includes managing payroll taxes, sales taxes, and any various other tax obligations specific to building. To succeed in the duty of a building and construction accountant, individuals need a solid academic foundation in audit and finance.

In addition, qualifications such as Cpa (CPA) or Licensed Building And Construction Sector Financial Professional (CCIFP) are highly concerned in the market. Functioning as an accountant in the building and construction market includes a special set of difficulties. Building and construction projects typically entail tight deadlines, changing guidelines, and unforeseen costs. Accounting professionals must adjust rapidly to these obstacles to maintain the project's monetary health and wellness intact.

Pvm Accounting Fundamentals Explained

Ans: Building accountants develop and monitor spending plans, identifying cost-saving opportunities and making certain that the project stays within budget. Ans: Yes, construction accountants manage tax obligation conformity for building and construction projects.

Introduction to Building Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction companies have to make difficult choices among many financial options, like bidding process on one job over an additional, choosing financing for materials or devices, or setting a task's profit margin. Construction is an infamously volatile market with a high failing rate, sluggish time to settlement, and inconsistent money flow.

Manufacturing entails repeated procedures with conveniently recognizable costs. Production requires various procedures, materials, and equipment with varying costs. Each job takes place in a brand-new area with differing site conditions and one-of-a-kind obstacles.

The Single Strategy To Use For Pvm Accounting

Frequent use of various specialty service providers and providers affects performance and cash flow. Payment shows up in full or with routine settlements for the complete agreement amount. Some section of settlement might be withheld up until project completion also when the contractor's job is ended up.

While typical producers have the benefit of controlled environments and maximized manufacturing procedures, building and construction firms should frequently adjust to each new project. Even somewhat repeatable jobs need alterations due to site problems and other variables.

Report this page